Long Straddle Strategy

Long Straddle Strategy

Long straddle is perhaps the simplest market neutral strategy to implement. Once implemented, the P&L is not affected by the direction in which the market moves. The market can move in any direction, but it has to move. As long as the market moves (irrespective of its direction), a positive P&L is generated. To implement a long straddle all one has to do is –

- Buy a Call option

- Buy a Put option

Ensure –

- Both the options belong to the same underlying

- Both the options belong to the same expiry

- Belong to the same strike

Example:

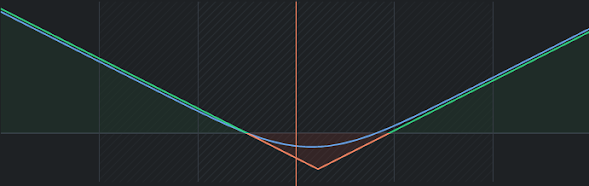

Max Profit : Unlimited

Payoff Table

Key Points :

Break-even 21179 to 21621

if Nifty Expiry between Break-even levels you will end up making loss of hole capital which is deployed in this trade.

Note:

- Strategies which are insulated to market direction are called ‘Market Neutral’ or ‘Delta neutral’

- Market neutral strategies such as long straddle makes money either which way the market moves

- Long straddle requires you to simultaneously buy the ATM Call and Put option. The options should belong to the same underlying, same strike, and same expiry

- By buying the CE and PE – the trader is placing the bet on either direction

- The maximum loss is equal to the net premium paid, and it occurs at the strike at which the long straddle has been initiated

- The upper break-even is ‘strike + net premium’. The lower break-even is ‘strike – net premium’

- The deltas in a long straddle adds up to zero

- The volatility should be relatively low at the time of strategy execution

- The volatility should increase during the holding period of the strategy

- The market should make a large move – the direction of the move does not matter

- The expected large move is time bound, should happen quickly – well within the expiry

- Long straddles are to be set around major events, and the outcome of these events to be drastically different from the general market expectation.

Comments

Post a Comment